Analyzing European telecom markets for deal likelihood and investment upside.

As part of a recent client engagement, we looked at the attractiveness of the European telecom sector, specific markets, and targets. While several operators have successfully hived off their tower and fiber assets and these assets have recently outperformed the telcos themselves, the client had questions about which markets and which operators offered the most upside. We share some of our perspectives and a couple of unique analysis our team leveraged for this work.

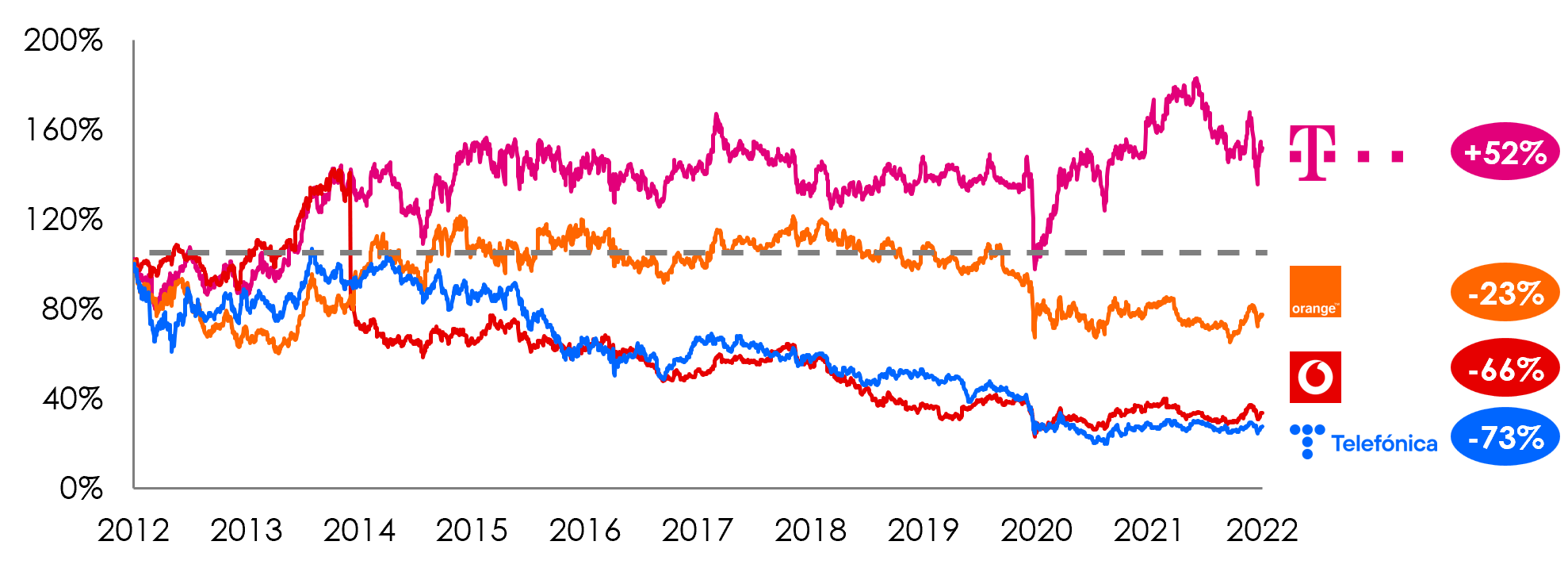

Operators have seen their stock price decline between 23% to a whopping 73% over the last 10 years

Operators have seen their stock price decline between 23% to a whopping 73% over the last 10 years

The 2010s have mostly been a lost decade for European telco investors, due in part to the regulator’s drive to make mobile phone service affordable. Figure 1 shows the historical stock price performance of the four largest telecom operators in Europe. Barring Deutsche Telekom, operators have seen their stock price decline between 23% to a whopping 73% over the last 10 years.

Figure 1: European Telco historical stock price

Sources: Nasdaq, 3HA Research & Analysis

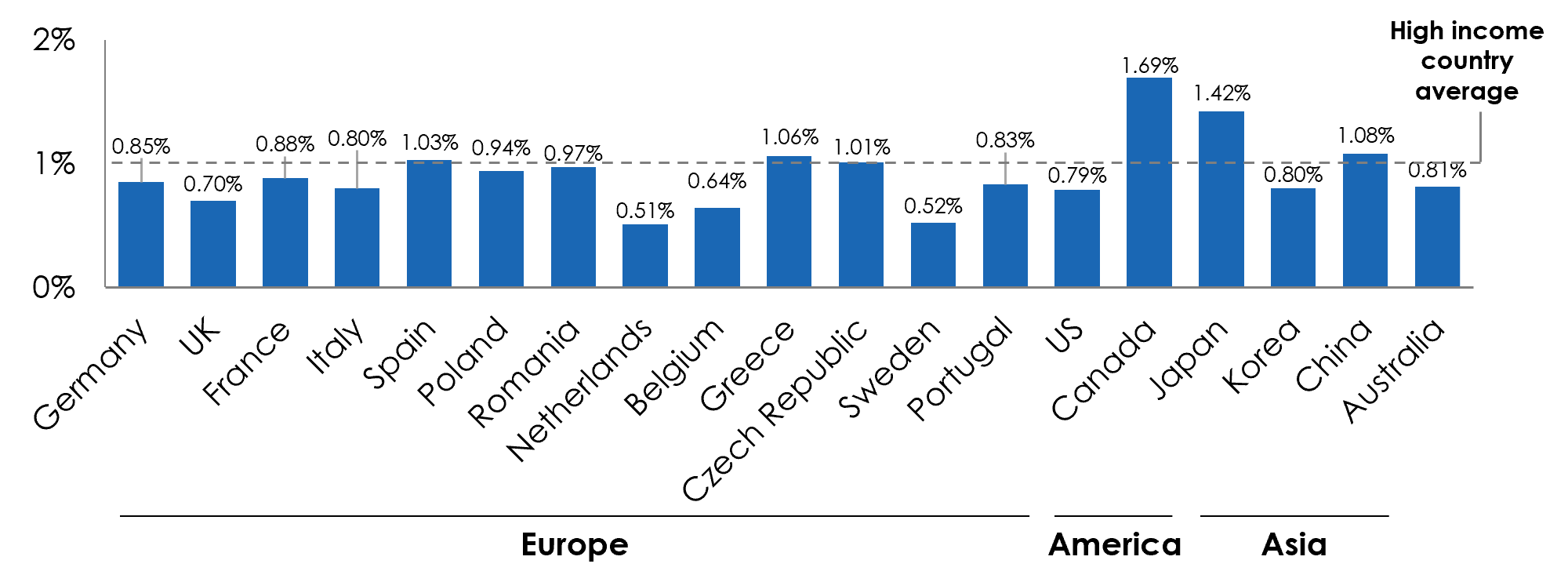

Regulator’s goal of affordable mobile tariffs has largely been achieved as shown in Figure 2 with some of the most affordable mobile plans available in Western Europe among all high-income countries. In the 13 largest European telecom markets, the median mobile bundle price is 0.85% of per capita GNI which is approx. 15% lower than the average across high-income countries globally.

Figure 2: Mobile price as a % of GNI per capita

Sources: Alliance for Affordable Internet, ITU

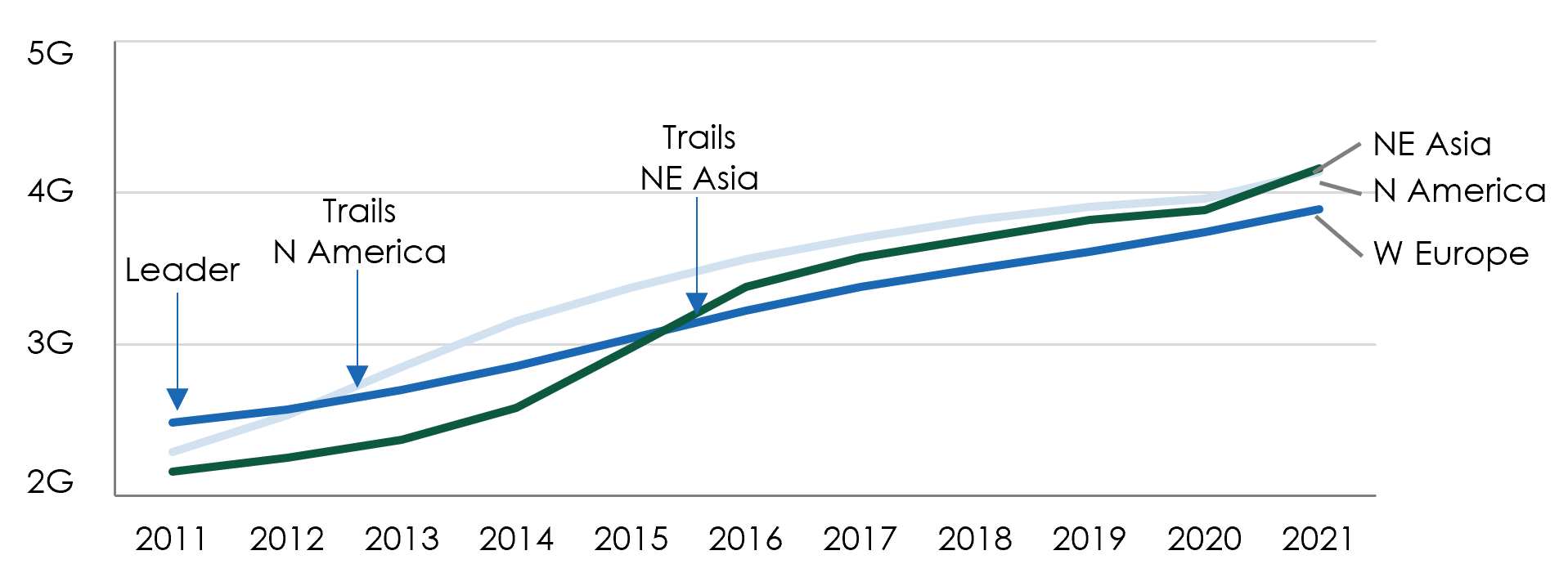

In this environment, poor returns combined with stringent antitrust regulations across the continent have driven operators to generally underinvest in the network. While W European operators have historically been a step or two behind their N American counterparts in 4G LTE coverage, this underinvestment is likely to set the continent back quite a bit in the race for 5G supremacy. At the end of 2021, both N America and NE Asia were significantly ahead of Western Europe in 5G network investments and transitioning users to devices supporting the latest technology. Figure 3 shows a simplified metric that quantifies the progress across regions in adoption of the latest cellular technology.

Figure 3: Weighted average “G” across mobile subscriptions

Sources: Ericsson, 3HA Research & Analysis

If European regulators want their markets to avoid being laggards again when it comes to 5G deployment and adoption, they need to prioritize leadership in technology over discounted mobile tariffs. This would require an openness not seen in the market for over two decades when it comes to spectrum policy as well as to mergers.

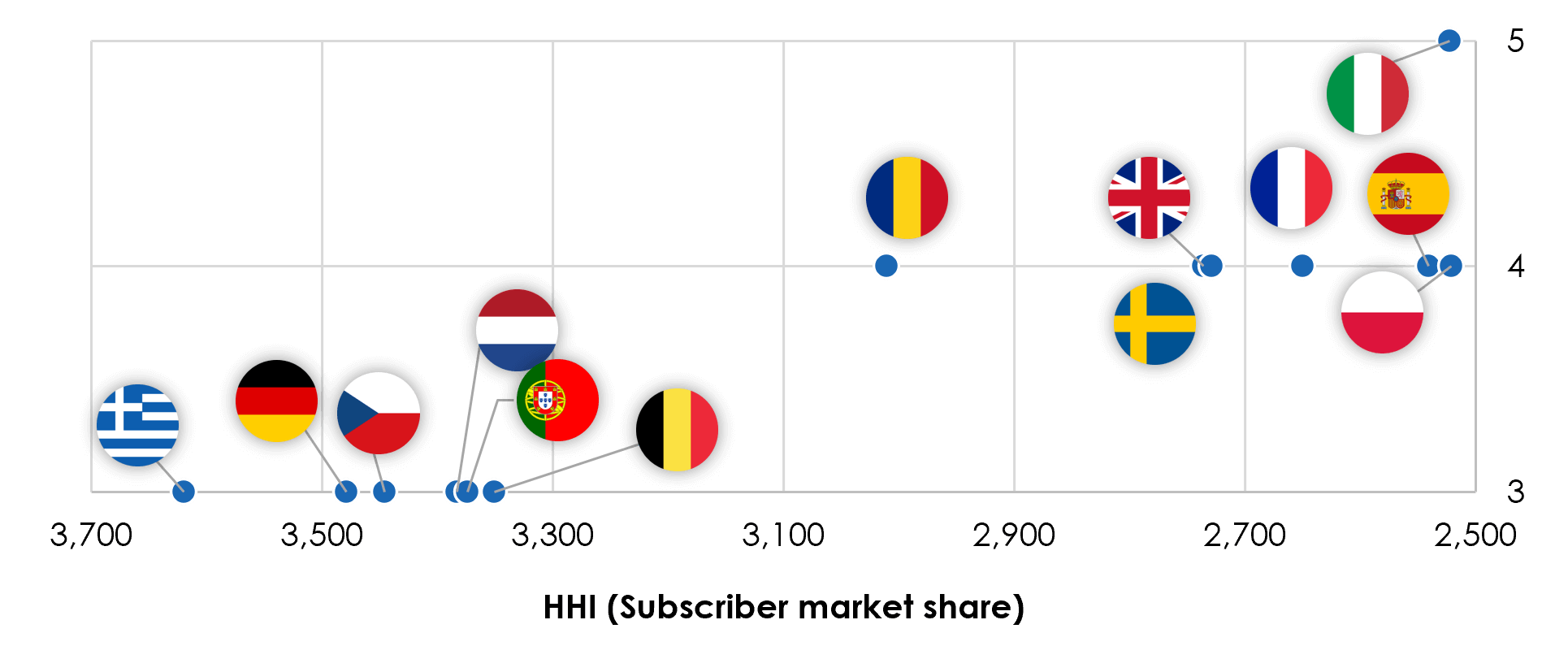

We assessed the competitive intensity in these markets, both by the number of nationwide mobile operators as well as the mobile market concentration, as calculated by the widely used Herfindahl-Hirschman Index (HHI) leveraging the subscriber market share, ex-M2M subscriptions. While 6 of 13 markets are operating with only 3 mobile networks, 6 markets have 4 operators and Italy has 5 nationwide operators. Looking beyond the number of operators, as shown in Figure 4, markets with 4 and 5 mobile operators seem to be most competitive.

Figure 4: HHI vs. number of operators

Sources: Telco Quarterly & Annual Reports, 3HA Research & Analysis

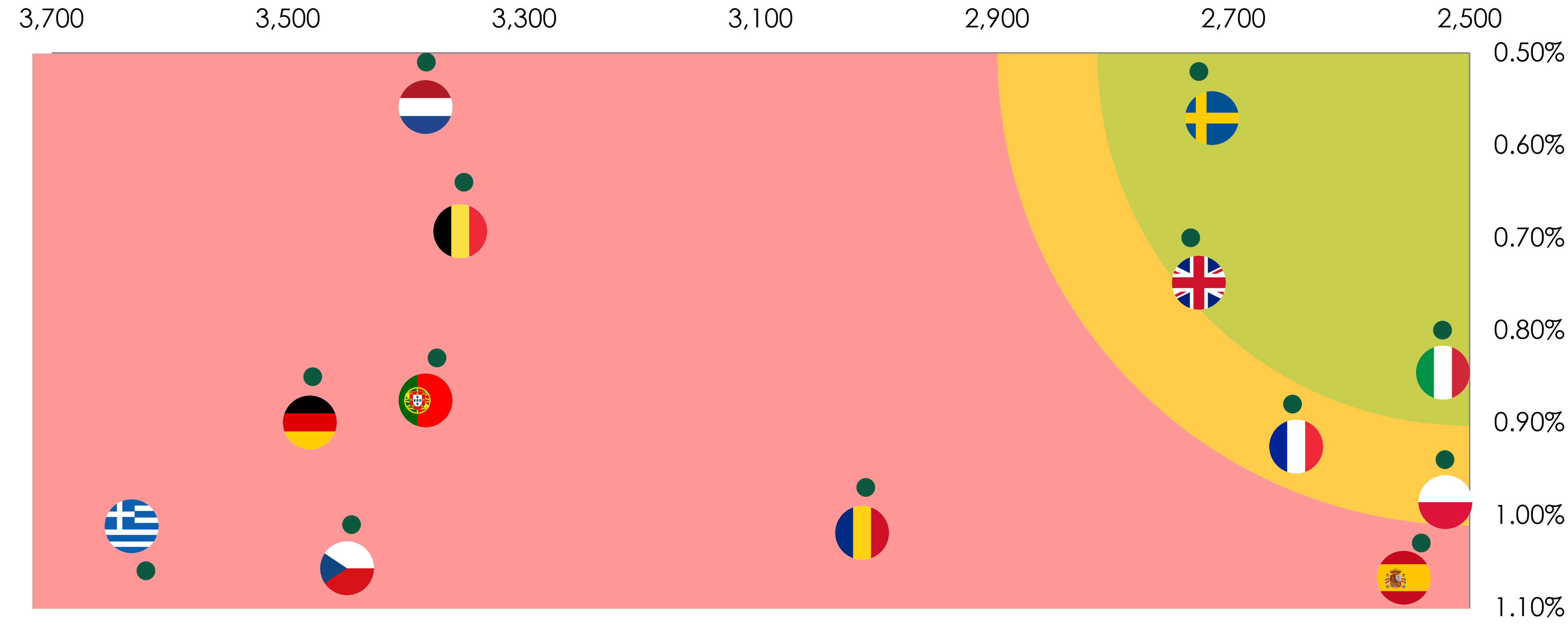

Markets with the most affordable tariffs and the least market concentration offer the least risk from a regulatory standpoint and incumbents and/or investors have the greatest odds of success in making their case for consolidation. This analysis shows Italy, UK, and Sweden could be at the vanguard of deal making in the European telecom sector.

Figure 5: HHI vs. Mobile Price as % of GNI Per Capita

Sources: Telco Quarterly & Annual Reports, Alliance for Affordable Internet, ITU, 3HA Research & Analysis