Will Netflix overcome serious challenges and gain traction in India?

“The thing that frustrates us is why haven’t we been as successful in India.”

“The thing that frustrates us is why haven’t we been as successful in India.”

That was Reed Hastings, Founder and Co-CEO of Netflix in January 2022. It is a familiar refrain we’ve heard from numerous executives over the past 15+ years. The large and growing middle class and relative openness of the economy vs. China has beguiled Western executives for decades.

Based on our prior experiences crafting the turnaround plan for the floundering India business of a Fortune-100 OEM and architecting and helping drive a differentiated strategy that established a communications service provider as a market leader, we believe India poses unique challenges that require a distinctive strategy. While not surprising, it is depressing to see nonnative businesses repeat mistakes of years past. As part of a recent engagement with an OTT media service client, we conducted a deep-dive into Netflix’s strategic missteps and excerpted here are 4 lessons learned and key questions to be answered.

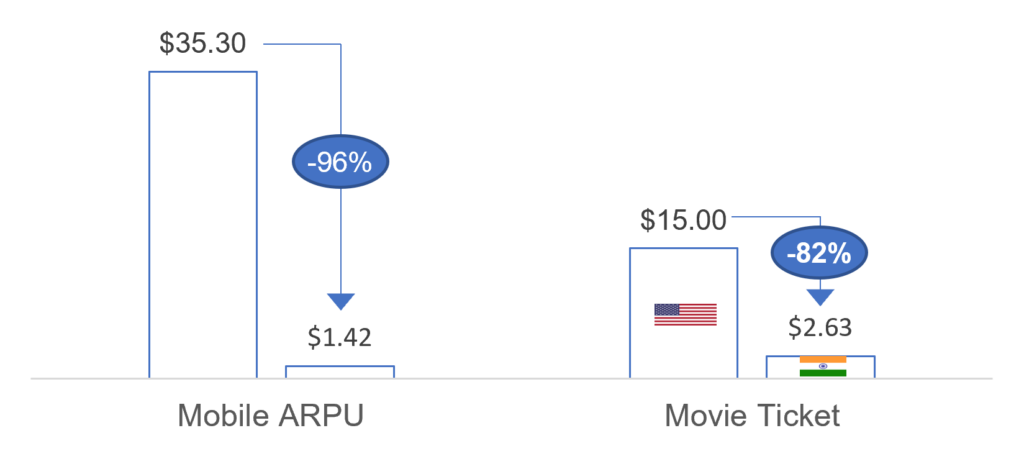

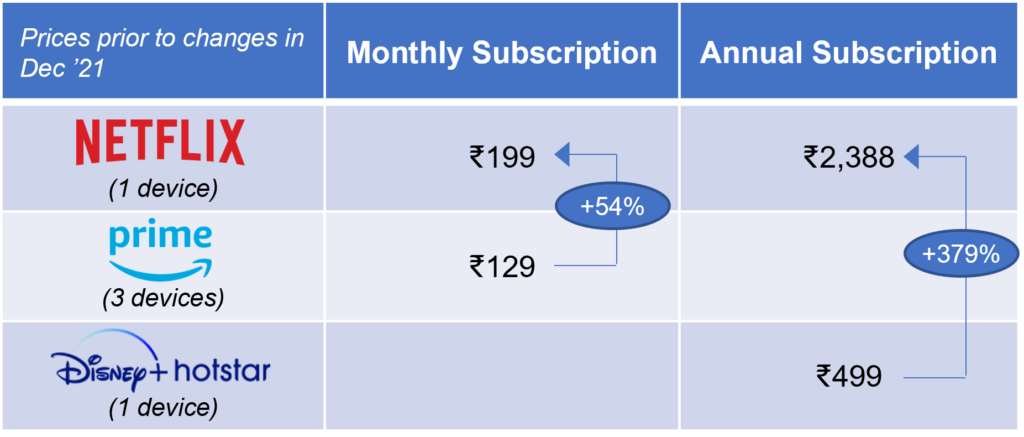

Pricing: Up until the price cut in Dec 2021, the basic plan cost ₹499, equivalent to $6.58. While this was a 27% discount to the then U.S. basic plan price of $8.99, it was way out of line with what the market could bear. Market-level discounts for analogous services indicate a 80-95% discount in India compared to U.S. prices.

Sources: TRAI, 3HA Research & Analysis

Netflix also failed the litmus test of competitor prices.

Sources: 3HA Research & Analysis

Even after the price decrease, Netflix’s mobile-only annual subscription is 258% more expensive than the Disney+Hotstar subscription. It goes without saying that Netflix’s pricing continues to be out of sync with its stated growth ambitions.

Related Read: Prime – The ‘real’ price for Prime over time and consumer response to prior price hikes

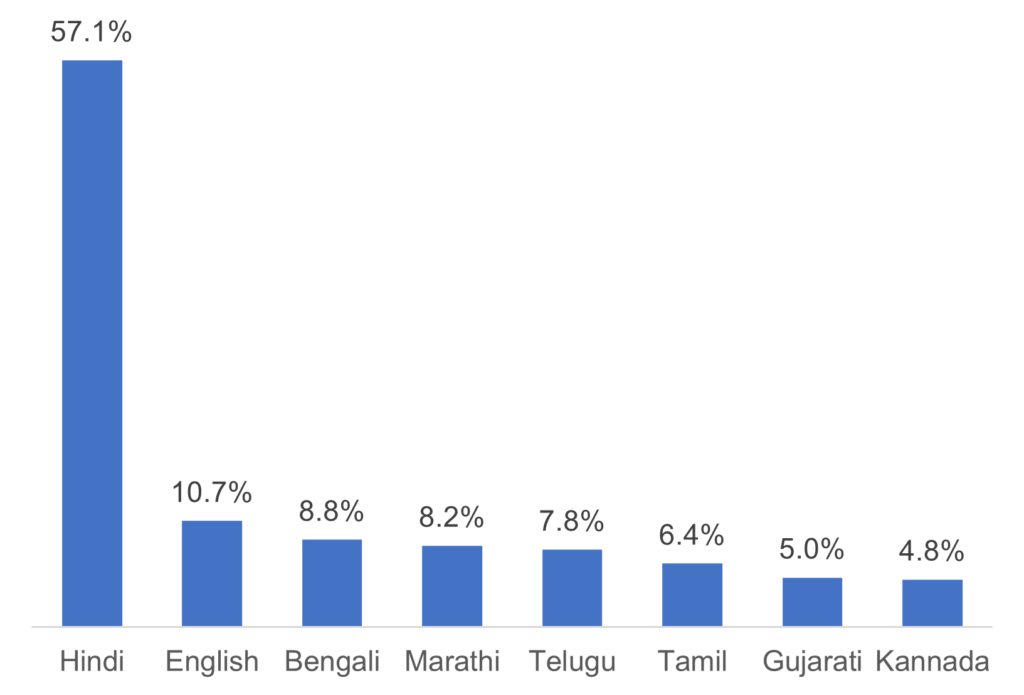

Localization: Any product or service predicated on English language fluency, especially with aspirations to grow beyond the proverbial 1 percent, is bound to fail in India. Furthermore, while Hindi can expand the addressable market, it still only addresses a little more than ½ the population. Mobile device OEMs, mobile service providers and app developers have all had a well developed multi-language strategy for over a decade. This would apply to both the app interface as well as investments in content. Netflix India offers extremely limited original content in languages other than Hindi. Among the 27 scripted original shows released for India through 2021, 59% are Hindi language, 30% are English including Hindi/English and only 11% are in other languages. 8 scripted shows in the pipeline reflect more of the same strategy.

Total speakers as a % of population (1st, 2nd and 3rd language)

Sources: Government of India, Ministry of Home Affairs, 3HA Research & Analysis

Distribution: Partnerships have always been vital for western brands to expand in India across categories. India has a very low incidence of credit card usage with only about 5% of Indians having access to credit cards. Prepaid cards and cash on delivery are uniquely Indian payment mechanisms that enabled the growth of e-commerce over the past 15 years.

For a digital product that is sold without in-person interaction with consumers, partnerships with service providers who already have a recurring payment relationship with consumers is essential. With over 1 billion mobile subscriptions, mobile network operators are natural partners. Four years after launching in the market, Netflix finally struck a partnership with the 3rd largest mobile operator in Q1 ’20 and subsequently with what is now the largest operator in Q3 ’20. However, questions remain if a strategy dependent on the “wholesale” channel can drive long-term profitable growth.

Device strategy: Netflix pioneered the mobile-only plan in India in early 2019 and competitors Prime and Disney+Hotstar followed suit much later in 2021. This is a critical enabler of success for any direct to consumer content based business as the penetration of wired internet and computers is only 9% and 11% of households respectively. Despite being first to market, limited adoption of paid digital subscriptions in the market overall combined with a lack of broad distribution prevented Netflix from making much headway. Work remains to be done in optimizing video quality, reducing data usage, and improving quality of service alongside the push to increase average hours streamed per subscriber.

Covid-19 accelerated the adoption of digital wallets with Google, Amazon and 3 Indian payment service providers each having between 100 million to 200 million users. The leading vendor, Paytm added an automatic bill payment feature for OTT platforms in Nov 2021. This opens the door for OTT players to go direct to a broader set of consumers than was possible previously.

Is the company selling a BMW to consumers looking for a Tata Nano?

Is the company selling a BMW to consumers looking for a Tata Nano?

Several strategic and tactical questions remain unanswered:

- Should Netflix focus on subscriber share or revenue share?

- How should Netflix respond to the aggressive pricing by the market leader?

- What is its India content strategy beyond Bollywood?

- Is it time to launch an ad-supported plan?

- What are the levers to create a lower cost model?

- Are there acquisition opportunities to jump-start subscriber base and local content library?