Rationale for Canadian telecom merger and assessing Competition Bureau’s stance

The most exciting news in the telecom sector in N America in the past week was Rogers Communications and Shaw Communications announcing their plan to go to court to save their merger against opposition from the country’s antitrust watchdog. While the Competition Bureau’s rationale is to preserve competition in the wireless market, Rogers’ CEO has stated that “this was, from the very outset, a cable acquisition for us”. Rogers has initiated talks with prospective buyers for Freedom Mobile, but we wonder if this is necessary to win approval. If the companies are going to court to save the deal, why not retain the wireless business, gain necessary spectrum depth, and quickly gain further scale in the future growth engine for most telcos around the world?

Having supported telecom mergers with in-depth analysis across many markets, we analyze if they stand on solid ground in terms of defending their merger. The Canadian telecom regulators have recently been a step or two behind those in other advanced economies in terms of promoting investments in the sector. Key lowlights in the wireless space include:

- Most OECD countries had already made mid-band spectrum assignments before Canada conducted its 3.5 GHz auction in mid-2021

- Canadian regulators routinely use set-asides that limit the amount of spectrum available to incumbents, leaving them with smaller slices of spectrum in each band

- Spectrum pricing during auctions is among the highest in OECD countries, e.g., normalized for a 20-year term, Canadian national service providers paid USD 2.62 per MHz-Pop vs. USD 1.12 per MHz-Pop in the C-band auctions in the U.S., itself being one of the most expensive auctions ever

These actions among others have left the incumbent wireless operators in Canada relatively spectrum poor. After the most 5G auctions conducted in 2021, Rogers, Bell, and Telus have 226 MHz, 222 MHz, and 158 MHz of population weighted spectrum nationwide respectively in the sub-6 GHz spectrum bands. In comparison, the U.S. operators each have well over 300 MHz of sub-6 GHz spectrum. This liberalized spectrum approach infuses networks with new capacity that lowers costs and spurs rivalry.

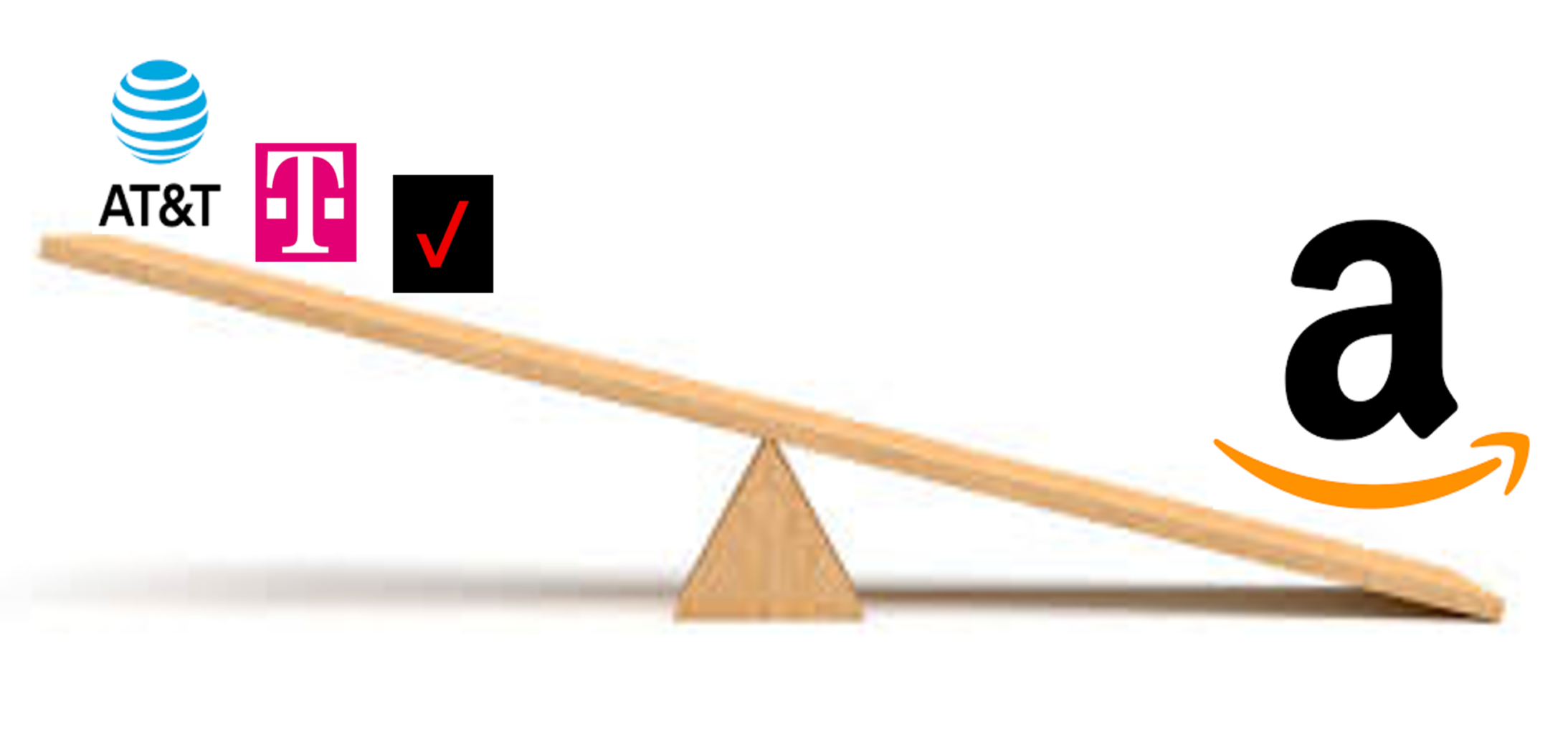

During a recent engagement, we benchmarked the price of mobile bundles across OECD countries and Canada has by far the highest prices as a % of GNI, a whopping 69% higher than the “high income” country average.

Figure 1: Mobile price as a % of GNI per capita

Sources: Alliance for Affordable Internet, ITU

This said, wireless subscribers in Canada currently enjoy among the best networks in the world, ranking 16th in median download speeds among 142 countries according to the March 2022 version of the Speedtest Global Index. This places Canada well ahead of most major economies including the U.S., France, Germany, U.K., and Japan. So maybe the Canadians are getting an ok deal if you take into account the quality of service!

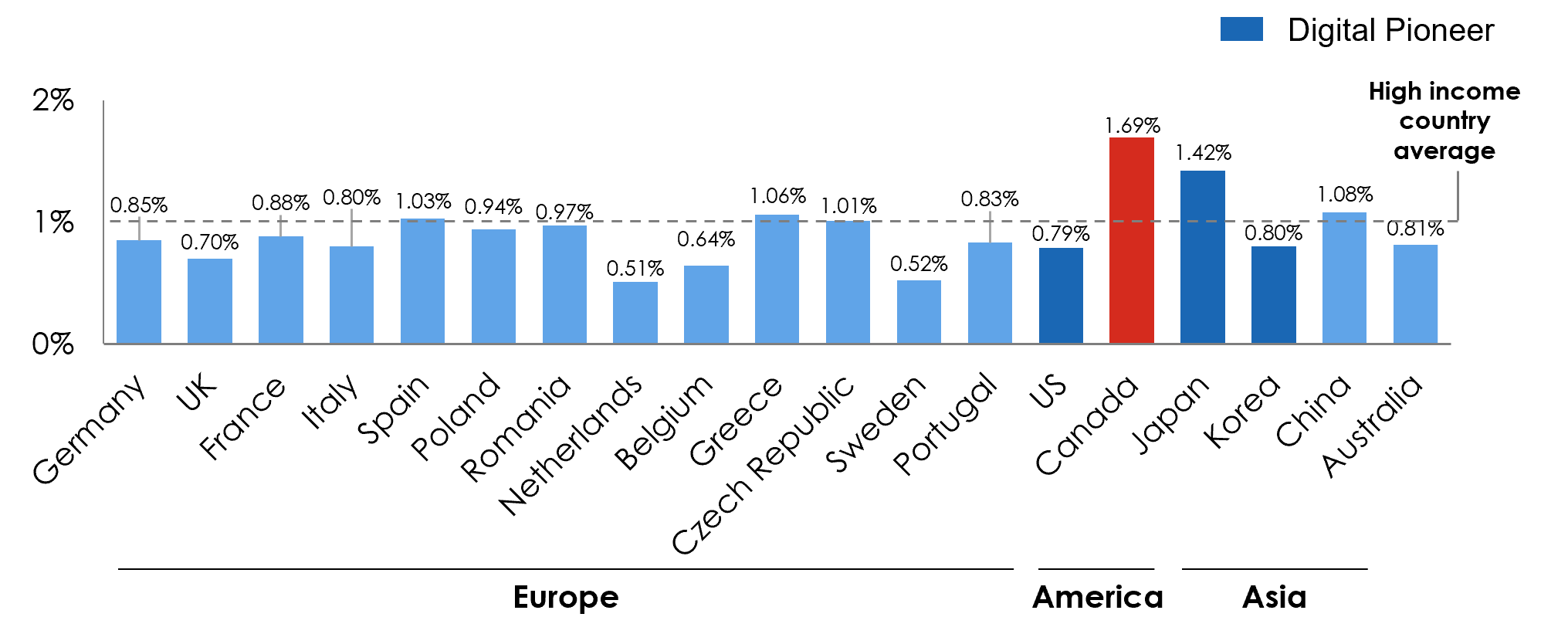

On the face of it, the “high price” justifies the actions of Canadian regulators to create a more competitive environment for wireless services. However, many of the policy remedies sought by the regulator, including those mentioned above, have significantly increased the cost of operating nationwide wireless networks. This is borne out in the underperformance of 3 of 4 telcos compared to the Toronto stock market index, by a whopping 33 to 42 ppts over the last 10-years.

Figure 2: Canadian Telco historical stock performance

Sources: Nasdaq, 3HA Research & Analysis

Number of industry participants vs. industry concentration

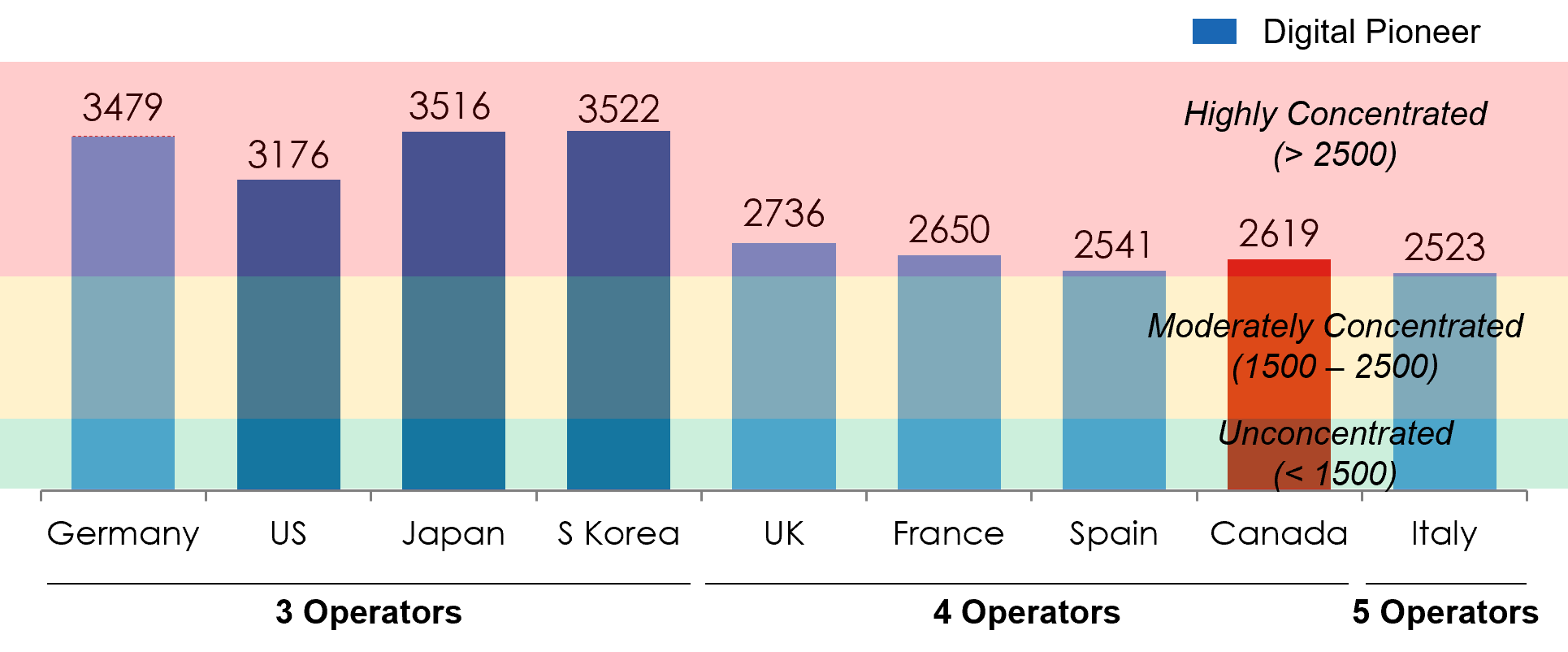

Most major markets have either 3 or 4 nationwide (or in Canada’s case, multi-regional) operators. While this means the market concentration is high across markets, there is significant variation in the competitive intensity across these markets. Historical market share distribution within each market and operator’s varying growth and investment posture drive these differences. The market concentration as measured by the Herfindahl-Hirschman Index (HHI) for these nine markets is shown in Figure 3.

Figure 3: Wireless market concentration (subscriber share HHI)

Sources: Telco Quarterly & Annual Reports, ITU, GSMA, 3HA Research & Analysis

This analysis indicates that the wireless services market is highly concentrated in all major markets and the Canadian market is among the least concentrated now. However, it is important to note that the digital pioneer markets all have 3 national operators and are among the most concentrated. We believe scale driven benefits derived from greater concentration and a supportive regulatory environment encourages operators in these markets to invest in next generation offerings.

Related Read: T-Mobile – Sprint Merger Assessment

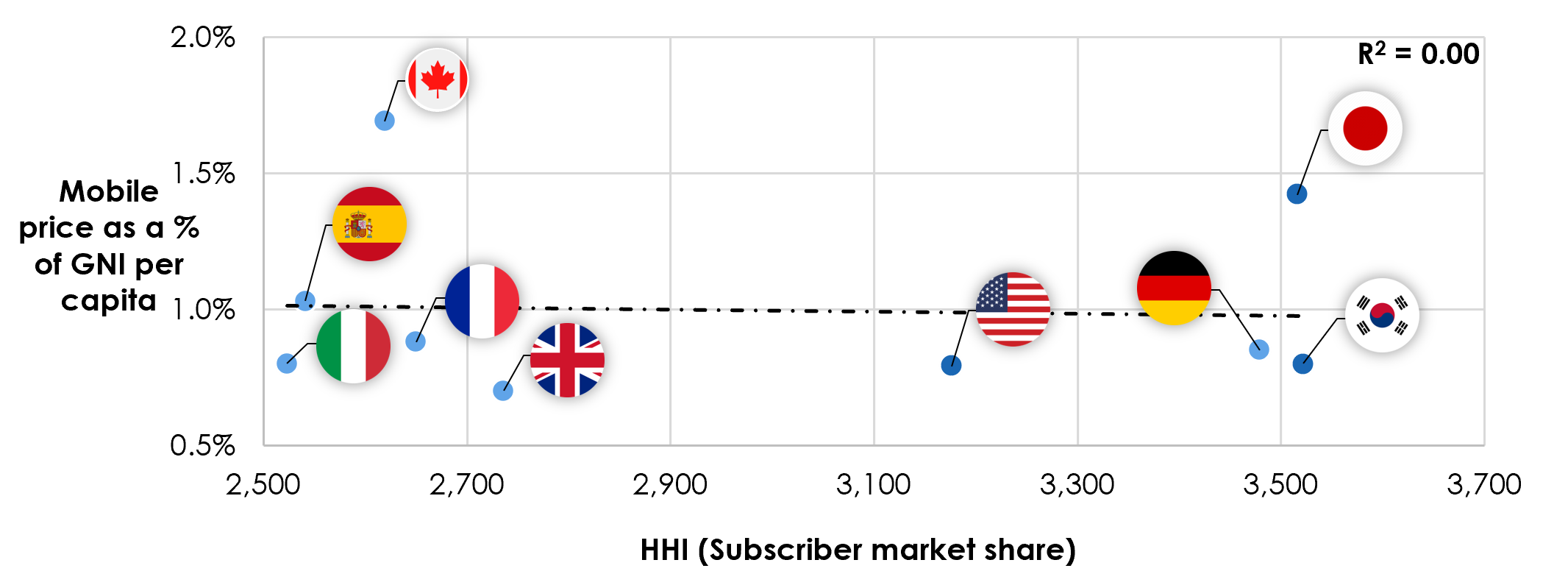

While the Canadian regulator’s quixotic endeavor to create a 4th national operator has not made wireless bundles much more affordable, it certainly has caused the Canadian operators to fall behind the digital pioneers in rolling out 5G networks. In a highly capital-intensive industry like wireless where investments in a new generation of technology happens every 10 years or so, empirical data soundly rejects the argument that higher competitive intensity leads to lower prices.

Figure 4: Correlation of market concentration and mobile price

Sources: Telco Quarterly & Annual Reports, Alliance for Affordable Internet, ITU, GSMA, 3HA Research & Analysis

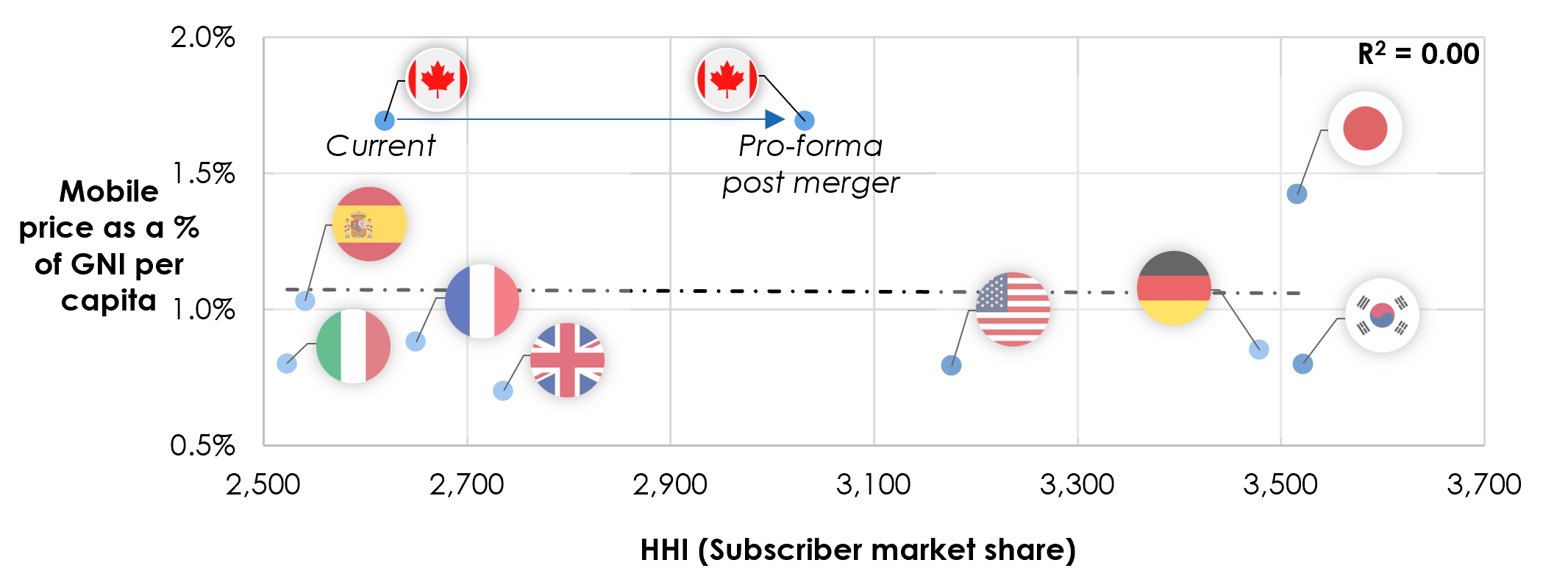

What will the merger, if approved, do to wireless market concentration?

The merger of Rogers and Shaw will result in a HHI increase of over 400 points for the wireless market to approx. 3,030. Yet, the market will be less concentrated than the digital pioneers – U.S., Japan, and Korea as well as Germany.

Figure 5: Pro-forma market concentration change post-merger

Sources: Telco Quarterly & Annual Reports, Alliance for Affordable Internet, ITU, GSMA, 3HA Research & Analysis

This assumes the new entity maintains the combined market share of the two separate entities which would lead the antitrust watchdog to conclude they will have enhanced market power. The companies could in turn argue that Videotron’s extensive wireless network and sizable market presence in Quebec along with the impending entry of Cogeco into the Quebec and Ontario markets would present viable competitors in many of the major markets across Canada. In the 1st 5G spectrum auctions conducted in Canada during 2021, regional players acquired over 20% of the total spectrum available, giving them a springboard to launch next generation wireless offerings. The inroads Comcast and Charter have made in the wireless market in the U.S., entirely based on an MVNO type arrangement is a great case study. Furthermore, they could argue that the high fixed costs, increasingly concentrated vendor landscape, and constantly evolving technology landscape that require huge investments all drive the need for greater scale. T-Mobile and Sprint were successful in making a similar argument to the U.S. regulators that the combined company will be better positioned to invest in next generation networks and help the country lead in the race for 5G supremacy. Indeed 2 years hence, the U.S. leads China in both 5G availability and 5G penetration among users.

The regulators could approve the merger with a set of conditions imposed on the merging entities. These potential conditions include:

- Enhanced coverage obligations, especially in rural areas

- Affordable pricing plans or cap on price increases for an extended period

- Competitive wholesale network offering

- This would build on the landmark ruling last year by the Canadian Radio-television and Telecommunications Commission which stated it will mandate that the country’s large wireless incumbents give regional providers wholesale access to their networks for seven years

- Mandatory participation in future spectrum auctions

- Divestiture of spectrum and / or entry of a new player. However, the record of standing up a new nationwide entrant as a precondition to mergers is spotty

- Iliad’s entry in the Italian market as a precondition to Wind and Three Italia’s merger approval has allowed them to gain a 12% market share. However, according to the Speedtest Global Index, Italy trails all the other countries in this analysis, except Spain. So consumers may have more options, but they also have to endure sub-par networks overall

- Dish’s entry into the U.S. market as a result of the settlement agreement with the Department of Justice hasn’t made much of an impact. They have a sub 2.5% subscriber market share and have lost nearly 1 Million subscribers in the 2 years since the acquisition of the Boost Mobile brand

- Divestiture of prepaid brand(s), where subscribers are most sensitive to price increases

Will Canada follow in the footsteps of the U.S. and consolidate down to 3 viable operators across geographies or will the regulators remain steadfast in trying to create a 4th national operator?