Companies can avoid common pitfalls in merger integrations by adopting these best-in-class acquirer practices

Nearly 2/3rds of mergers have failed historically1 and most companies have limited integration management skills on staff. Historically, organizations have focused on minimizing risks and realizing the cost savings by reducing redundant people and operations. Identifying and capturing transformational value requires a different and difficult approach.

Successful integration can not only reduce the risk of missing synergy targets, but also help identify revenue growth opportunities above and beyond due diligence estimates. Using the right tools and approaches can also accelerate successful merger integration. A differentiated approach has the added benefit of stemming potential loss of talent or a lengthy integration distracting the organization from delivering on the core business.

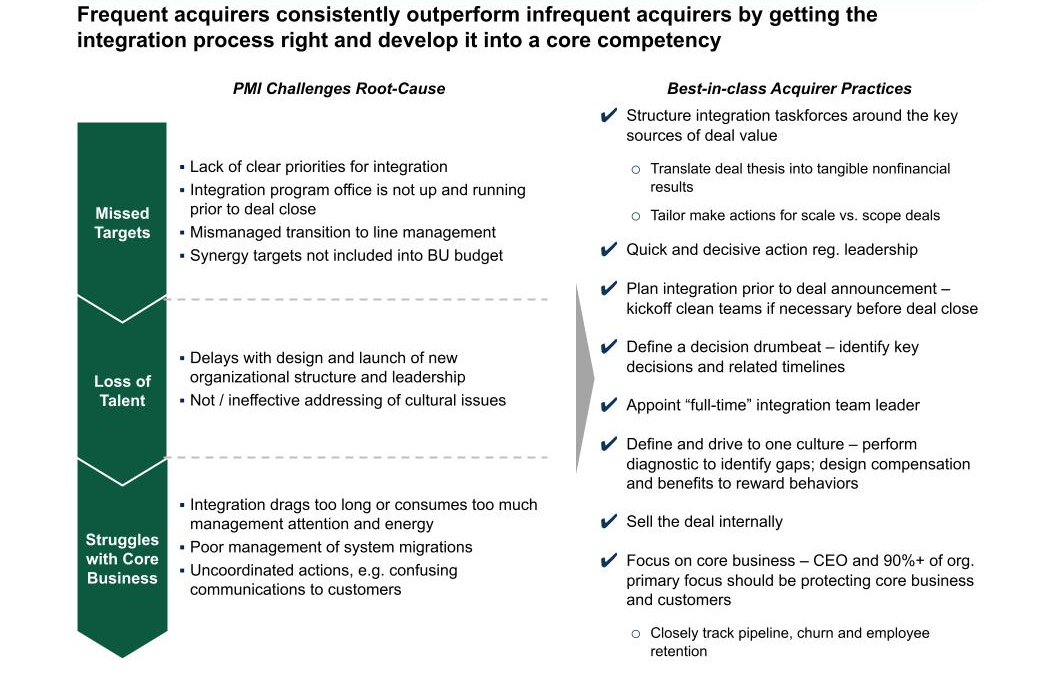

The root cause of these issues and practices of best-in-class acquirers to pre-emptively address them is described below:

Figure: Key lessons learned from prior M&A integrations

Source: HBR: The Big Idea: The New M&A Playbook by Clayton M. Christensen, Richard Alton, Curtis Rising, and Andrew Waldeck, March 2001