Kevin Formica, CIP Capital on how PE firms are adapting.

As a follow-up to our previous article analyzing the record-shattering year for U.S. Private Equity and what might be in store for the sector, we spoke with Kevin Formica, Principal at CIP Capital for his take on what PE firms can expect and how he thinks they will adapt to the evolving environment.

1. The headlines are all about the unprecedented capital raises by mega funds. How has the fundraising environment been for mid-market and smaller GPs? What do you expect going forward?

Given the continued strong performance of private equity vs. other asset classes, LPs have continued to increase their private equity allocations, sometimes meaningfully (see CalPERS example below). This has created a very favorable fundraising environment for both large, established funds as well as emerging managers. This may be anecdotal, but it feels like we are seeing more $1bn+ first-time funds than we have in a long time, maybe ever. First-time funds who have a well-defined investment strategy, strong management team, and proven track record tend to be the most successful. Another trend I have seen is that fundraising cycles have also been compressed significantly, with some funds coming back to market less than 2 years after their previous fundraise.

As a part of the larger strategic asset allocation plan approved in mid-November, CalPERS will be increasing its private equity portfolio from 8 percent to 13 percent of its total assets, or roughly $25 billion. CalPERS is selling some Treasuries and stocks to push further into privates.

Institutional Investor LLC, Dec 6, 2021

As a part of the larger strategic asset allocation plan approved in mid-November, CalPERS will be increasing its private equity portfolio from 8 percent to 13 percent of its total assets, or roughly $25 billion. CalPERS is selling some Treasuries and stocks to push further into privates.

Institutional Investor LLC, Dec 6, 2021

2. How do you expect deal activity to trend in the next 1-2 years?

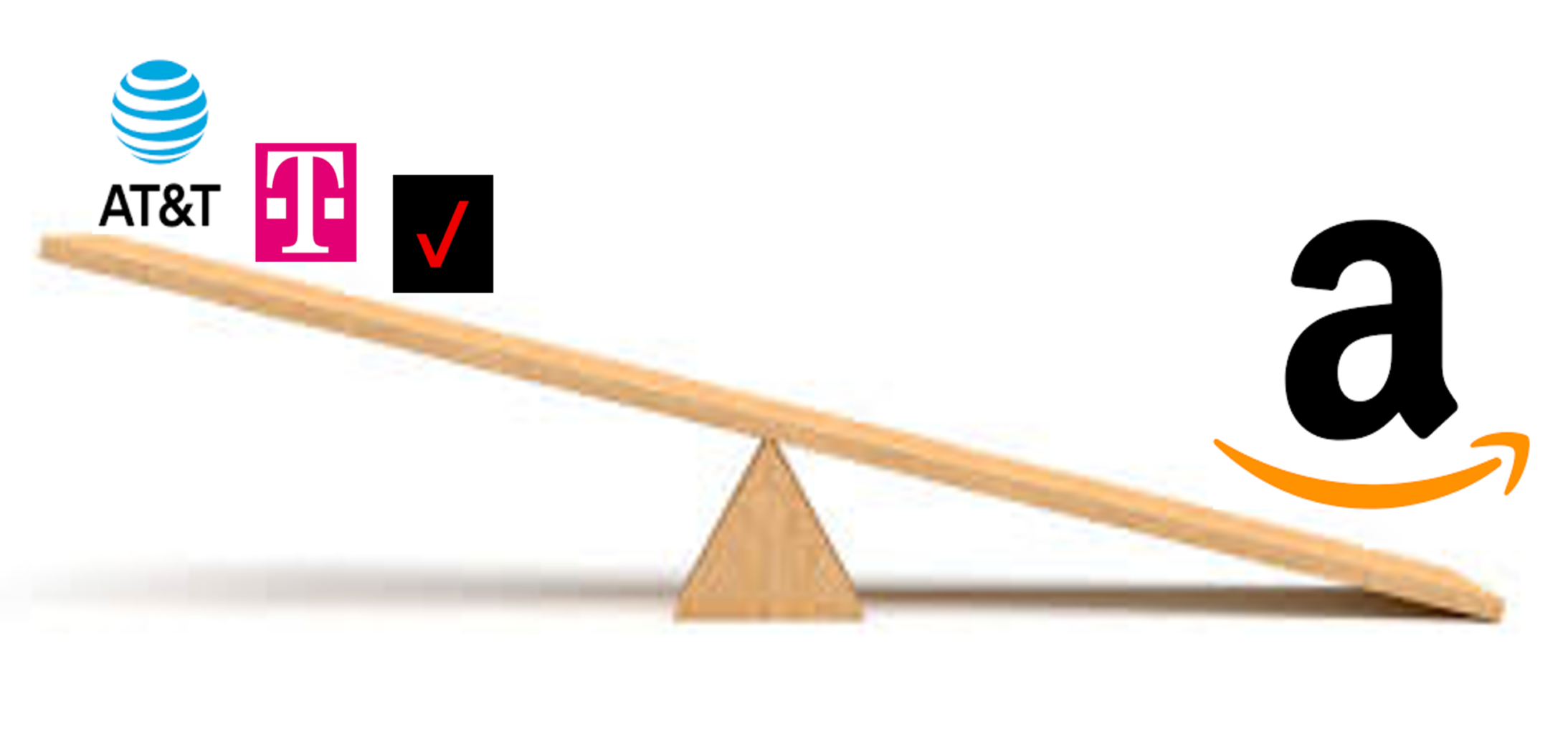

Private equity dry powder continues to be at an all-time high and is not expected to slow down anytime soon. That capital needs to be deployed somewhere. While private equity funds will continue to be selective around investments, the market is only going to get more competitive, not less so. One trend we could see is PE firms increasing their take-private activity, whether traditional take-privates or take-privates of companies that went public via SPAC that perhaps shouldn’t have gone public in the first place. I think this is a trend we could see accelerating over the coming years simply based on the fact that the number of high quality, private companies is ultimately finite.

3. Do you foresee significant compression in private market multiples? What sectors or parts of the market are under greatest threat?

I don’t believe private market multiples will compress significantly based on the amount of dry powder available and the need/desire to deploy capital quickly.

Related Read: Is the democratization of PE a recipe for mediocrity?

4. How, if at all, has your approach to due diligence changed as the macroeconomic tide turns?

Diligence timelines have compressed but the core due diligence process remains intact. Buyers that receive preferred treatment in a process typically have a pre-existing sector thesis and as such their “market” diligence is substantially complete before they pursue a specific asset.

5. Given the high deal multiples, have add-ons become more critical to your firm’s investment strategy? Are revenue synergies more in focus for add-ons?

Add-ons have always been a critical part of our value creation strategy. There are a number of ways to add value through add-ons including:

- expansion into a high-growth vertical end market,

- product/service expansion,

- enhance technology or data/analytics capabilities,

- cost synergies, and

- accretive valuation multiples as compared to the platform as a whole.

I think revenue synergies are one component of that equation, but not “outsized” as compared to the other factors.

6. Has your engagement with portfolio companies intensified given the new set of challenges they’re facing – inflation, labor shortages, and supply chain issues?

Our engagement intensified when COVID first hit as we worked to shore up our portfolio companies’ capital structures and take the appropriate cost containment measures, if necessary. Inflation / labor shortages / supply chain issues have not required quite the same hands-on approach since we primarily work with asset light businesses that are not as impacted by supply chain issues. The primary impact that we have seen has been on the labor side, and frankly that’s been more of a P&L item than an operational initiative that we need to address (increased budgets for current cost of labor, increased merit increases vs. historical levels, retention bonuses, spending more on recruiting due to the competitive market, etc.).

7. Is pricing a major lever for your portfolio companies?

Selectively, yes. But every situation is different. It depends on the end market, customer base, competitive environment, etc. – what can they and what will they accept.

Kevin is a Principal at CIP Capital, a private equity firm focused on platform investments in growth-oriented, middle-market companies across the business information and tech-enabled services sectors. Kevin’s investment activity focuses on tech-enabled business services across automotive, real estate, and industrial sectors.