Spectrum holding evolution for key players in the U.S. market

To borrow a popular quote, those in the telecom industry have lived with the credo that “spectrum is the new oil” for over 30 years. Operators in the U.S are coming off a period where they spent nearly $125B in acquiring new spectrum. With the 3HA team recently kicking off an engagement for the upcoming FCC spectrum auction, we completed an in-depth analysis of the spectrum holdings for key players in the market, how this has evolved over time and what this might mean for future competition.

U.S. Carrier spectrum landscape evolution

Where were we?

While spectrum is the enabler of sustained success in wireless, having a lot of it does not guarantee success – exhibit 1 is Sprint’s slide into irrelevance prior to its acquisition by T-Mobile. While Sprint has had the most spectrum among U.S. carriers thanks in part to its leases with licensees of the EBS spectrum, it is only in the last few years that Sprint and now T-Mobile has started deploying it. Also, not all spectrum is created equal, as the coverage and propagation characteristics vary widely across the spectrum bands. Additionally, only in the last decade or so has the applicability of mid band spectrum come to the fore with the adoption of smartphones and the seemingly never ending growth of mobile data consumption. Previously the basis of competition used to be coverage which was most effectively done with low-band spectrum.

On the other end of the spectrum, Verizon has been a poster child for being spectrum starved up until it spent approx. $55B on C-band and CBRS spectrum. One can argue that acquiring Dish which had 90 MHz of population weighted spectrum prior to these auctions might have been a far cheaper option, subject to regulatory approvals.

So where do the operators stand now?

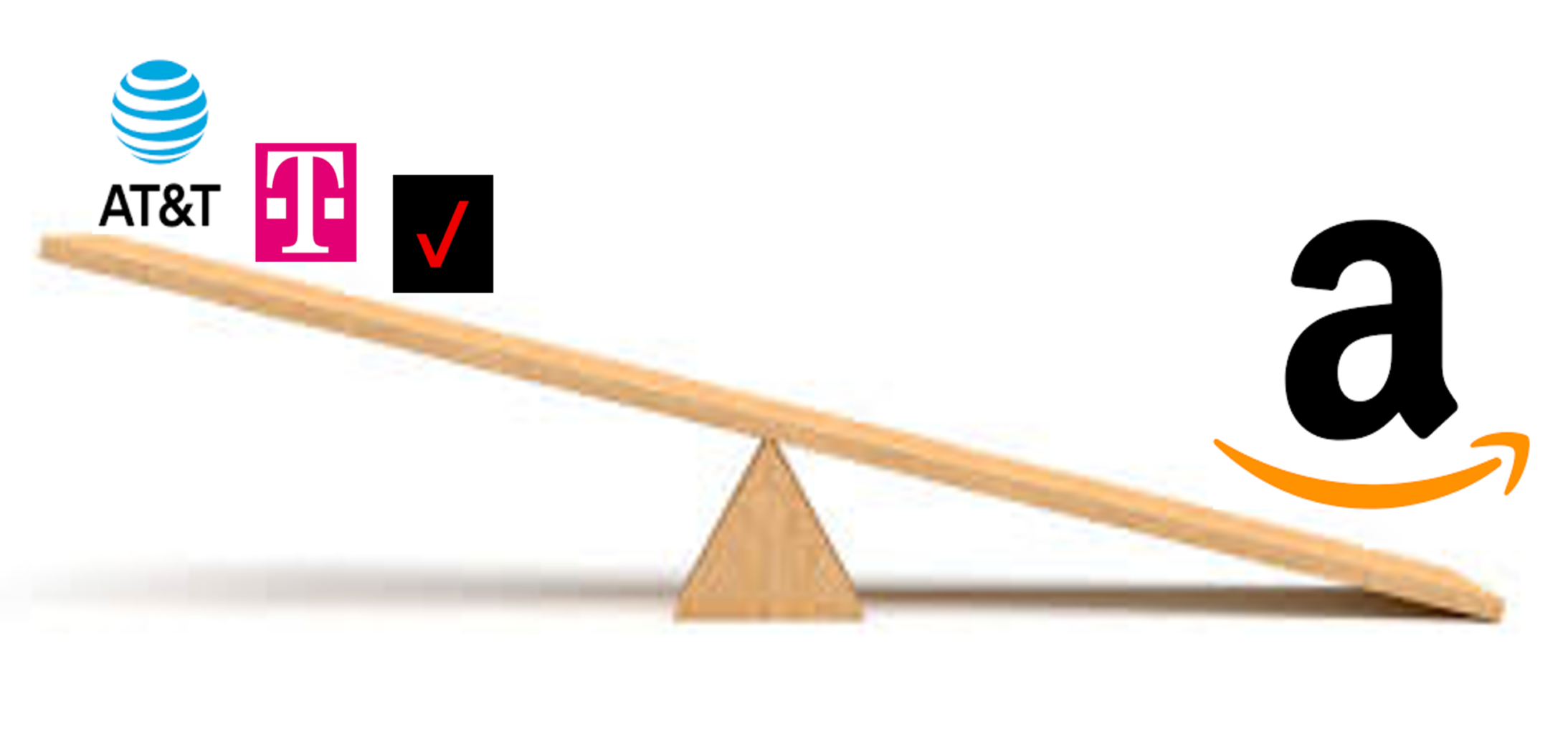

While operators can overcome spectrum shortage with investments in the network, this is usually prohibitively expensive, both in terms of capex and opex, and returns have been sub-par, especially on small cell investments for localized capacity augmentation. We use spectrum per subscriber as a simplified metric to do an apples-to-apples comparison. Using this metric, we find that Verizon has 45% less spectrum than T-Mobile and while AT&T is in a much better position, it too lags T-Mobile by 25%. So even after they commission all the new spectrum, Verizon and AT&T will trail T-Mobile by a wide margin and will need to continue bearing high capex and opex costs to offer a high quality of service. To state the obvious, T-Mobile has plenty of runway to offer cheap prices to continue to gain ground on the market leader. This also gives T-Mobile an opportunity to make a furious bid for home broadband customers with its fixed wireless offering.